National investment fraud lawyers KlaymanToskes is investigating Walter Lim (CRD# 1747688) after an investor complaint filed against the Morgan Stanley broker, alleging an unsuitable covered call options trading strategy, resulted in $673,000 in investor damages.

According to FINRA Brokercheck, Lim has two disclosed investor complaints. The most recent complaint, filed in November 2022, alleges that Lim implemented an unsuitable covered call options strategy in a Morgan Stanley customer’s account in 2021 and 2022. The complaint is pending and alleges investor damages of $673,000. A second customer complaint alleged that Lim unsuitably managed an investor account when he was registered with Citigroup Global Markets.

Investors who suffered losses with Walter Lim at Morgan Stanley’s San Francisco, CA branch are encouraged to contact attorney Lawrence L. Klayman at (888) 997-9956 or lklayman@klaymantoskes.com for a free consultation to learn about recovery options.

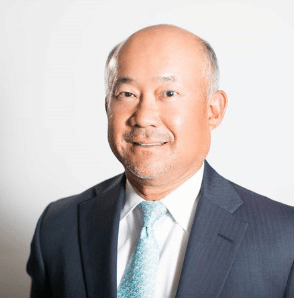

Walter Lim a/k/a Walter Chaing Lay Lim (CRD# 1747688)

KlaymanToskes has recovered millions of dollars for investors that suffered investment losses due to unsuitable covered call writing strategy recommendations.

Our firm has many years of experience representing customers in cases related to covered call writing strategies and options management services programs that resulted in stocks being called away against major Wall Street brokerage firms. Many investors we have recovered losses for include employees of public companies and founders that received stock as compensation.

The unsuitable investment strategy of selling covered call options on stocks is often employed by brokerage firms on concentrated portfolios. When the strategy is implemented improperly, it can lead to investors experiencing severe losses of thousands of shares or significant amounts of money buying back the shares.

Former and current customers of Walter Lim and/or Morgan Stanley’s San Francisco, CA branch who have experienced significant investment losses are encouraged to contact securities attorney Lawrence L. Klayman, Esq. at 1-888-997-9956 or lklayman@klaymantoskes.com for a free and confidential consultation to discuss recovery options.

KlaymanToskes offers legal services on a contingency fee basis, meaning we do not collect attorney’s fees unless we are able to obtain a financial recovery for you. KlaymanToskes also has the experience and resources dedicated to your case, allowing the firm to recover over $250 million for investors in FINRA arbitration cases alone.

About KlaymanToskes

KlaymanToskes is a leading national securities law firm which practices exclusively in the field of securities arbitration on behalf of retail and institutional investors throughout the world in large and complex securities matters. The firm has recovered over $250 million in FINRA arbitrations and over $350 million in other securities litigation matters. KlaymanToskes has office locations in California, Florida, New York, and Puerto Rico.

Lawrence L. Klayman, Esq.

888-997-9956