NEW YORK, NY / ACCESSWIRE / November 1, 2022 / Investors that suffered significant losses holding large, concentrated positions of Nikola Corp (NASDAQ:NKLA) at full-service brokerage firms are encouraged to contact national investment fraud lawyers KlaymanToskes to recover their losses.

Nikola’s Performance

NKLA started trading on June 4, 2020, at $37.55. The company’s high and volatile share price between March and September 2020 was a result of former executive Chairman Trevor Milton giving investors a false impression of Nikola’s products and technology, according to the SEC’s Order earlier this year. Nikola was fined $125 million for these misrepresentations and omissions.

The artificially inflated share price left investors with a false sense of security. However, financial advisors and their firms had the experience to recommend risk management strategies to large shareholders. The implementation of these strategies could have saved investors millions of dollars before NKLA hit today’s share price of $3.58.

Advisors Had an Opportunity to Hedge

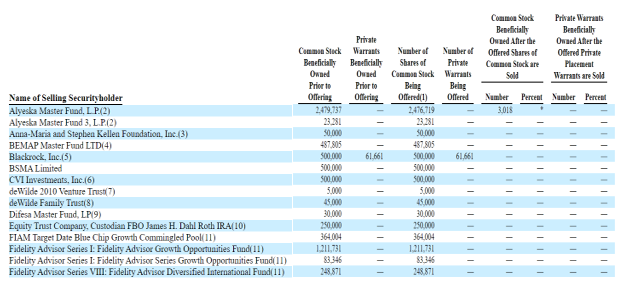

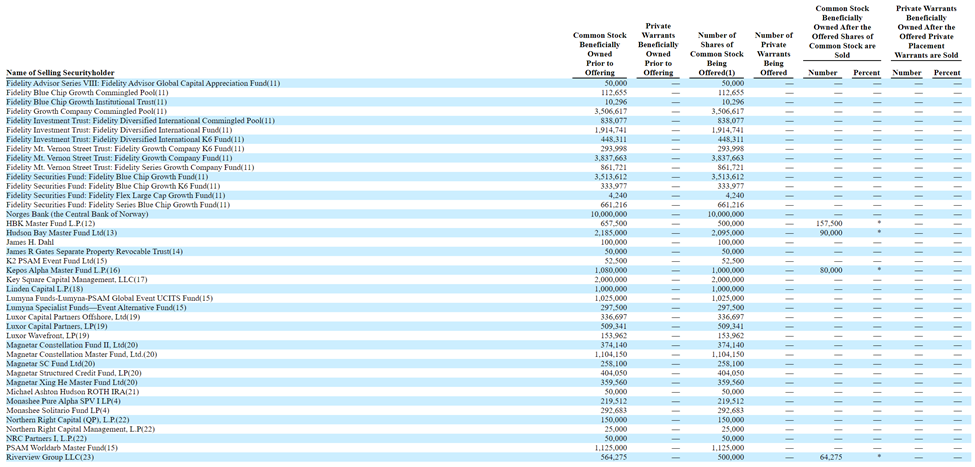

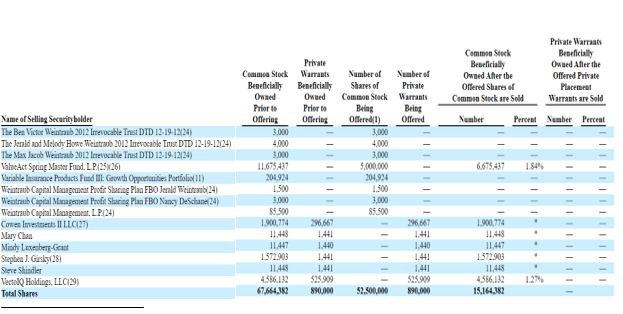

On June 15, 2020, days before the price began to decline, Nikola filed its S-1 with the SEC. The filing shows that most well-known funds, such as BlackRock and Fidelity, were planning to sell their entire positions of NKLA. In fact, the entities planned to sell over 52 of 67 million shares. This was a clear indicator for advisors and their firms to diversify or hedge any large, concentrated positions before the price fell.

Brokerage firms have a duty to provide suitable investment advice to their customers, including risk management strategies. Large shareholders that were unaware of these options can hold their brokerage firms liable in FINRA arbitration claims.

If you suffered $100,000 or more in losses, contact securities attorney Lawrence L. Klayman, Esq. at 1-888-997-9956 or lklayman@klaymantoskes.com for a free consultation.

About KlaymanToskes

KlaymanToskes is a leading national securities law firm which practices exclusively in the field of securities arbitration and litigation on behalf of retail and institutional investors throughout the world in large and complex securities matters. The firm has recovered more than $250 million for investors in FINRA arbitrations and over $350 million in other securities litigation matters for its clients. KlaymanToskes has office locations in California, Florida, New York, and Puerto Rico.

Contact

KlaymanToskes

Lawrence L. Klayman, Esq.

1-888-997-9956

lklayman@klaymantoskes.com

www.klaymantoskes.com

SOURCE: KlaymanToskes, P.A.