If you have lost money in the stock market due to fraud, misrepresentation, negligence, or for other reasons, we can help you. We have successfully recovered over $250 million in FINRA securities arbitrations.*

Need Legal Help? Contact Us. Call +1 (888) 997-9956

KlaymanToskes, www.klaymantoskes.com, continues to investigate and pursue claims to recover investment losses suffered by investors in UBS’s (NYSE:UBS) Yield Enhancement Strategy (“YES”). KT has recently received important information relating to the marketing, offer, and sale of the YES strategy to UBS customers. KT believes that investor claims are meritorious as they relate to the marketing, offer, and sale of the YES strategy, including the sales presentation that was provided to customers.

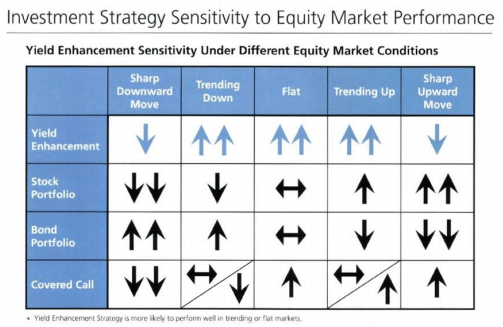

The YES program utilized an options strategy known as the Iron Condor, trading call and put options on the S&P 500. UBS characterized YES as a strategy that would have limited correlation to the market and as having downside protection. However, the YES strategy has shown significant correlation to the greater markets and limited downside protection.

YES investor losses have increased to approximately 40% due to a recent market event precipitated by the Coronavirus (“COVID-19”) pandemic. UBS has seen a large decline in the assets under management in YES, from $6 billion in 2018 down to $1.5 billion.

The sole purpose of this release is to investigate whether the YES strategy employed by UBS was suitable for investors and whether UBS misrepresented its risks. Current and former investors with accounts at UBS who participated in YES, and have information relating to the manner in which the firm handled their portfolios, are encouraged to contact Lawrence L. Klayman, Esq., at (561) 542-5131, or visit our firm’s website at www.klaymantoskes.com.