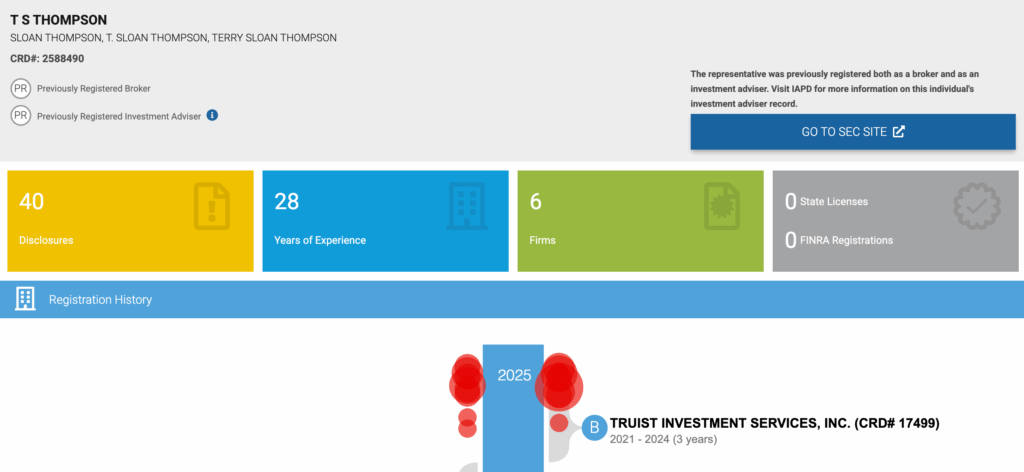

Terry Sloan Thompson (CRD# 2588490), a former broker with Truist Investment Services, has been named in over 39 investor complaints, with at least 33 resulting in financial settlements totaling more than $5.5 million, according to FINRA BrokerCheck.

These disputes span from 2022 to 2025, with the vast majority occurring in 2024 and 2025—and more allegations remain pending. While not class-action lawsuits, the claims—handled through FINRA arbitration—allege unsuitable investment recommendations, high-risk trading, and misrepresentation in managed accounts. If you are an investor who experienced similar losses, you may be eligible to pursue recovery through FINRA arbitration.

National investment loss lawyers KlaymanToskes is investigating broker Terry Sloan Thompson of Truist Investment Services Inc. (CRD #2588490).

According to FINRA BrokerCheck, broker Terry Sloan Thompson, also known as T. Sloan Thompson or T.S. Thompson, has 39 investor complaints and was terminated from Truist Investment Services, Inc. for allegedly failing to report or timely report client complaints related to unsuitable investment recommendations.

KlaymanToskes is currently representing investors who suffered losses with financial advisor Terry Sloan Thompson. If you suffered losses due to unsuitable investment recommendations, you may be entitled to a financial recovery through FINRA arbitration.

If you have investment losses due the actions of broker Terry Sloan Thompson, contact the investment loss attorneys at KlaymanToskes today at +1 (888) 997-9956 or request a free case evaluation to determine if you are eligible for recovery.

Investors that suffered losses with broker Terry Sloan Thompson are encouraged to contact attorney Lawrence L. Klayman, Esq., at 888-997-9956 or by email at investigations@klaymantoskes.com to discuss recovery options. We do not collect attorney’s fees unless we are able to obtain a financial recovery for you.

Terry Sloan Thompson (CRD# 2588490), also known as T. Sloan Thompson or T.S. Thompson, is a former broker who has been the subject of over 39 investor complaints, with at least 33 of those resulting in financial settlements. According to FINRA BrokerCheck, those settlements—most occurring in 2024 and 2025—total more than $5.5 million.

Thompson was terminated by Truist Investment Services in March 2024 for allegedly failing to report or timely report client complaints related to unsuitable investment recommendations. Common allegations include high-risk and unsuitable trading, misrepresentation, unauthorized transactions, and failure to follow client instructions. Many investors also cited significant losses in managed accounts despite conservative risk profiles. Several claims are still pending, and affected customers may be eligible for recovery through FINRA arbitration.

Investors that suffered losses with broker Terry Sloan Thompson are encouraged to contact attorney Lawrence L. Klayman, Esq., at 888-997-9956 or by email at investigations@klaymantoskes.com to discuss recovery options. We do not collect attorney’s fees unless we are able to obtain a financial recovery for you.

According to FINRA BrokerCheck, investors have filed over 39 complaints against former Truist broker Terry Sloan Thompson (CRD# 2588490), many of which allege misconduct related to the management of investment accounts. At least 33 of these disputes have resulted in financial settlements.

The claims—spanning from 2022 through 2025—allege a consistent pattern of concerning behavior, including:

Several complaints also allege that Thompson failed to report or timely report client issues to his firm—a factor that led to his termination from Truist Investment Services in March 2024.

These disputes were handled through FINRA arbitration rather than class-action lawsuits. If you experienced similar losses, you may be eligible to pursue recovery.

Below is a timeline of customer allegations and losses, including concerns about mismanagement, unsuitable trades, and failure to report complaints.

Allegation: Client alleges her money was mismanaged.

Allegation: Client alleges that his accounts suffered extensive losses while being managed by former representative

Allegation: Client allege high risk and unsuitable securities trading regarding managed investments during June 2021 and June 2024.

Settlement Amount: $93,388.43

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments during October 2021 and May 2024.

Settlement Amount: $467,321.98

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments during February 2021 and June 2024.

Settlement Amount: $95,269.30

Allegation: Client was concerned that their account was losing money during times of economic growth based on representatives’ advice.

Settlement Amount: $20,724.37

Allegation: Client alleges the representative mishandled his account and provided poor advice that resulted in the account underperforming.

Settlement Amount: $10,446.81

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments during March 2021 and August 2024.

Settlement Amount: $179,687.57

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments during February 2021 and September 2024.

Settlement Amount: $90,430.00

Allegation: Client alleges representative mishandled their accounts and gave poor advice, which allegedly resulted in the accounts severely underperforming.

Settlement Amount: $70,765.79

Allegation: Client had concerns with the performance of accounts.

Settlement Amount: $29,676.23

Allegation: Clients allege the representative mishandled their accounts and provided poor advice which affected the performance of the accounts.

Settlement Amount: $115,456.48

Allegation: Clients allege the representative made unstable trades and recommendations and are requesting reimbursement/compensation of funds lost as a result.

Settlement Amount: $406,786.76

Allegation: Client alleged that representative’s decision to short the market based on certain theories resulted in losses that were not recovered.

Settlement Amount: $92,315.82

Allegation: Client was unhappy with representative’s recommendations.

Settlement Amount: $23,555.01

Allegation: Client alleges account’s performance was lacking compared others.

Settlement Amount: $78,710.70

Allegation: Client alleges FA’s investment advice resulted in losses and poor account performance from August 2021 to March 2023.

Settlement Amount: $74,921.62

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments in February 2021 and April 2024.

Settlement Amount: $98,526.53

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments in February 2021 and December 2023.

Settlement Amount: $232,969.27

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments in February 2021 and April 2024.

Settlement Amount: $168,426.50

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments in February 2021 and May 2024.

Settlement Amount: $310,523.29

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments in February 2021 and November 2023.

Settlement Amount: $439,563.40

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investments in February 2021 and May 2024.

Settlement Amount: $290,639.87

Allegation: Clients allege high risk and unsuitable securities trading in managed investments in September 2021 and April 2024.

Settlement Amount: $135,945.51

Allegation: Clients allege high risk and unsuitable securities trading in managed investments in February 2021 and April 2024.

Settlement Amount: $203,898.98

Allegation: Client’s allege high risk, unsuitable recommendations and misrepresentation regarding managed investments in February 2021 and April 2024.

Settlement Amount: $298,787.54

Allegation: Client alleges poor performance resulting in considerable losses in managed accounts… placed into money market without her consent.

Settlement Amount: $20,892.28

Allegation: Clients allege high risk and unsuitable securities trading regarding managed investment in February 2021 and April 2024.

Settlement Amount: $233,703.28

Allegation: Clients allege high risk, unsuitable recommendations and misrepresentation regarding managed investments in February 2021 and April 2024.

Settlement Amount: $342,733.87

Allegation: Client alleges high risk and unsuitable securities trading in managed investments in February 2021 and April 2024.

Settlement Amount: $244,281.96

Allegation: Client alleges unsuitable recommendations were made by the advisor.

Allegation: Customer alleges advisor made unsuitable recommendations resulting in losses.

Allegation: Client alleges FA’s investment advice resulted in considerable losses and poor account performance over the last four years.

Settlement Amount: $23,135.79

Allegation: Client alleges that the account had performed poorly for the last several years and that she had been informed she was making money but feels that was not the case after reviewing her statement.

Settlement Amount: $56,543.07

Allegation: REPRESENTATIVE EITHER DID NOT REPORT OR DID NOT TIMELY REPORT CLIENT COMPLAINTS.

Allegation: Client alleged poor performance of the account.

Settlement Amount: $231,789.40

Allegation: Client alleged unsuitable recommendations in managed account.

Allegation: Client’s expressed concerns of poor performance in review of the managed investment accounts.

Settlement Amount: $220,285.38

Allegation: Customer alleges advisor failed to follow customer instructions

Settlement Amount: $123,517.44

Allegation: Client alleges losses to date due to poor advice.

Terry Sloan Thompson, also known as T. Sloan Thompson or T.S. Thompson, has been the subject of multiple investor complaints, according to his FINRA BrokerCheck report. Thompson, who was previously a registered broker with Truist Investment Services, Inc. in Savannah, GA, faced allegations from clients regarding unsuitable recommendations in managed accounts. Several of the complaints filed allege that Thompson engaged in high risk and unsuitable securities trading. Truist Investment Services, Inc. terminated Thompson in March 2024, citing that he either did not report, or did not timely report client complaints.

As an investor, there are a few signs that you should look out for if you believe you may have a claim against broker Terry Sloan Thompson. These signs could potentially indicate misconduct, negligence, or investment fraud. Investors are encourage to contact our firm immediately if you have experienced any of the following:

Some investors have close relationships with their brokers due to the time and trust built over the course of their investment relationship. However, it is crucial to remember that financial decisions should be based on careful analysis and due diligence rather than solely relying on personal relationships.

Engaging the services of an experienced securities attorney to evaluate your specific circumstances is strongly advised. At KlaymanToskes, our team of experienced securities attorneys has a deep understanding of this complex area of law, allowing us to provide invaluable insight and tailored guidance that directly addresses your individual needs.

If you suffered losses with broker Terry Sloan Thompson, or have concerns regarding your investment portfolio at Truist Investment Services Inc, contact KlaymanToskes at 888-997-9956 or fill out a short contact form for a free and confidential consultation.