RECOVER DAVID LERNER ASSOCIATES INVESTMENT LOSSES

National investment fraud lawyers KlaymanToskes is currently investigating FINRA arbitration claims against David Lerner Associates and its financial advisors for the sale of Energy 11 and Energy 12. We have filed FINRA claims seeking to recover significant damages. Investors that own Energy 11 or 12, or suffered investment losses following recommendations by David Lerner Associates and its financial adivsors are encouraged to contact our firm for a free consultation.

For More Information on The David Lerner Associates Investigation, Keep Scrolling

Do you have a case?

Consultation Form

Restoring Your Financial Lifestyle

KlaymanToskes is a leading national securities law firm that has recovered more than $250 million for investors in FINRA arbitrations.

Our firm practices exclusively in the field of securities arbitration and litigation on behalf of individual, high-net-worth, ultra-high-net-worth, and institutional investors throughout the world. We represent investors who have suffered investment losses at the hands of their trusted financial advisors and financial institutions.

KlaymanToskes has office locations in California, Florida, New York, and Puerto Rico.

Securities Litigation Recoveries

KlaymanToskes Investigates FINRA Arbitration Claims For Energy 11 and Energy 12 Investors

Investment fraud lawyers KlaymanToskes have filed FINRA arbitration claims against David Lerner Associates for the sale of Energy 11 and Energy 12.

According to the claims filed, David Lerner Associates (“DLA”) and its broker recommended unsuitable investment strategies to invest significant portions of client funds into proprietary energy funds that were far too volatile for the customers’ risk tolerance.

The unsuitable, illiquid investments include:

- Energy 11, Limited Partnership (“Energy 11”)

- Energy Resources 12, Limited Partnership (“Energy 12”)

The firm and its representative are alleged to have taken part in the following securities laws violations:

- unsuitable investments,

- overconcentration of investments,

- failure to act in the “best interest” of the investor,

- misrepresentations and omissions,

- breach of fiduciary duty,

- failure to supervise,

- conflicts of interest,

- negligence,

- and other violations of state and federal securities laws.

David Lerner Associates Investors: Did You Purchase Illiquid Investments?

If you purchased illiquid, alternative investments at David Lerner, contact our firm for a free, confidential consultation.

What are the Energy 11 and Energy 12 Funds?

The Energy 11 and Energy 12 Funds are high-commission, illiquid, non-traded financial products offered by David Lerner Associates and its brokers.

These investments were proprietary, meaning they were underwritten, marketed, managed, and sold by DLA, creating a conflict of interest in cases where investors entrusted their financial professionals to look after their best interests, rather than profiting off of their own recommendations.

Additionally, the underlying risks involved in the investments, sales charges and operating expenses were never fully explained to customers. According to the claims filed, some of these proprietary funds carried a maximum 5.75% sales charge at the time of purchase, a 1% deferred sales charge, and an annual fund operating expense of 1.43%.

DLA and its representatives continued to assure clients that their energy funds were safe and would allow investors to eventually receive their full principal back upon a liquidity event. However, the most recent pricing of Energy 11 shows that the fund has plummeted by over 50% and it allegedly owes $45 million in unpaid distributions to investors. All information current as of December 23rd, 2022.

DLA Broker Alert: Who Else May be Involved?

KlaymanToskes believes there are numerous representatives associated with the firm who may have sold unsuitable energy investments to their clients.

The following is a list of financial professionals who are currently, or have previously been, registered with David Lerner Associates with customer disputes:

- Michael Karp (CRD# 5102878) in Lawrenceville, NJ

- Tracy Alan Curtis (CRD# 5135421) in Westport, CT

- Ashley Roxanne Gaines (CRD# 5763258) in Westport, CT

- Ronald Lewis Morse (CRD# 341008) in White Plains, NY

- Peter John Testani (CRD# 5926700) in Syosset, NY

- Edward Levin (CRD# 2595745) in Huappauge, NY

- Robert Spencer Cavanaugh (CRD# 1494481) in Syosset, NY

- Lee Steven Ravodowitz (CRD# 371569) in White Planes, NY

- Thomas James Cerna (CRD# 1636698) in Syosset, NY

I Lost Money With David Lerner Associates – What Can I Do?

Investors who lost money at the hands of David Lerner Associates and its brokers have recovery options. KlaymanToskes has first-hand experience with DLA’s misconduct. Contact our securities attorneys at (888) 997-9956 to discuss your potential case.

David Lerner Associates: History of Misconduct

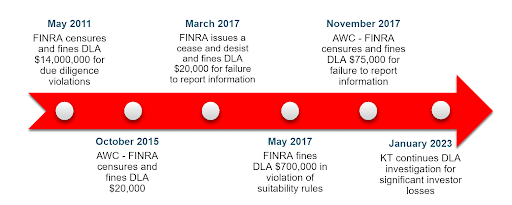

FINRA arbitration case 22-00019 is the latest of numerous misconduct issues DLA has had with the regulatory body. The firm has had a total of 40 public disclosures, including 21 regulatory events. The timeline below displays the notable disclosures on David Lerner Associates’ BrokerCheck report:

May 27th, 2011: FINRA censures and fines David Lerner Associates $14 million due to unfair pricing practices on municipal bond trades, requiring the firm to pay restitution to customers who incurred losses.

October 12th, 2015: FINRA enters into an Acceptance, Waiver and Consent (“AWC”) with David Lerner Associates. The firm is censured and receives a fine of $20,000 for failing to report securitized products in a timely manner.

March 3rd, 2017: FINRA issues a cease and desist and fines David Lerner Associates $20,000 for failure to maintain written reports of prior branch office examinations and written supervisory procedures.

May 24th, 2017: FINRA fines David Lerner Associates of $700,000 for not following its own compliance requirements for the sale of non-traded REITS.

November 2nd, 2017: FINRA enters into an Acceptance, Waiver and Consent (“AWC”) with David Lerner Associates. The firm is censured and receives a fine of $75,000 for failing to submit required forms to FINRA and for failure to maintain supervisory procedures.

January 2023: KlaymanToskes continues its investigation into David Lerner Associates and its representatives after filing claims for investors who incurred losses.

KlaymanToskes – Experienced Investment Fraud Lawyers

The investment fraud lawyers of KlaymanToskes have first-hand experience with broker misconduct at David Lerner. Contact us today at (888) 997-9956 to discuss your situation with the attorneys leading the DLA cases.

KlaymanToskes in the Media

We have represented employees from the following companies: