RECOVER ANTOINE SOUMA INVESTMENT LOSSES

National investment fraud lawyers KlaymanToskes have filed the latest action against Antoine Nabih Souma – a FINRA arbitration case seeking to recover $2 million in investment losses. Investors with losses resulting from the recommendations of Antoine Souma, The Souma Group, or Galliott Capital Advisors are encouraged to contact our firm for a free consultation.

For More Information on Antoine Souma, Keep Scrolling

Do you have a case?

Consultation Form

Restoring Your Financial Lifestyle

KlaymanToskes is a leading national securities law firm that has recovered more than $250 million for investors in FINRA arbitrations.

Our firm practices exclusively in the field of securities arbitration and litigation on behalf of individual, high-net-worth, ultra-high-net-worth, and institutional investors throughout the world. We represent investors who have suffered investment losses at the hands of their trusted financial advisors and financial institutions.

KlaymanToskes has office locations in California, Florida, New York, and Puerto Rico.

Securities Litigation Recoveries

KlaymanToskes Files Latest Action Against Antoine Souma for $2 Million

Investment fraud lawyers KlaymanToskes filed a FINRA arbitration case seeking $2 million in damages from the once renown financial advisor, Antoine Souma (CRD#: 4210987). Also named are Respondents Galliott Capital Advisors and Insigneo Securities.

According to the claim, the investor lost $2 million due to the following misconduct and violations:

- unsuitable investments,

- churning,

- unauthorized sales and purchases of securities,

- failure to act in the “best interest” of the investor,

- misrepresentations and omissions,

- breach of fiduciary duty,

- failure to supervise,

- negligence, and other violations.

Did You Lose Money with Antoine Souma? Attempt to Recover Your Losses

Have you suffered investment losses at the advice of Antoine Souma? Call us at (949) 721-9956 for a confidential, free consultation.

How Was Souma Involved?

According to the claim, a retired doctor entrusted Souma, Galliott Capital Advisors, and Insigneo Securities (“Respondents”) to devise a low risk, fixed income portfolio that was allocated between cash and short-term bonds. However, contrary to the investor’s instructions, Respondents engaged in an unauthorized strategy of misallocating the investor’s portfolio among longer duration bonds and bonds with lower credit quality. With the unauthorized changes to longer duration bonds, they also increased the risk of the account to include interest rate and credit quality risks.

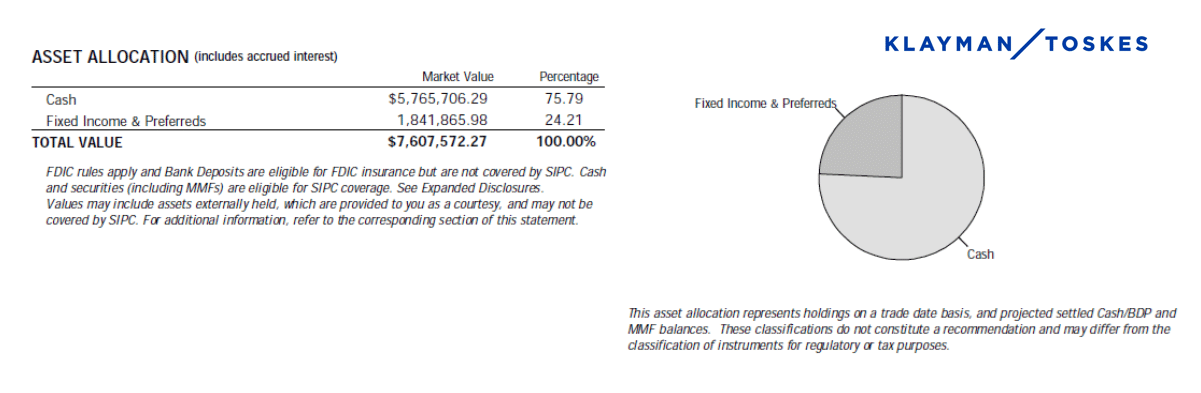

In early 2020, the investor began his relationship with Souma. By May of 2020, many of the short-term bonds in the investor’s account had matured and his account was allocated with $5,765,706 or 75.79% in cash and $1,841,865 or 24% in fixed income & preferred:

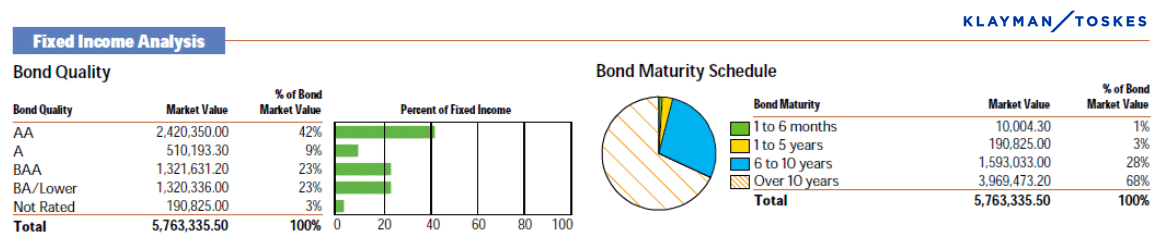

By the end of October 2022, the investor’s account is down nearly $2 million. The allocation was 15% in cash and 85% in Fixed Income. The Fixed Income was allocated with 67% of the bonds with maturities over 10 years and 25% of the bonds with maturities 6 to 10 years. 92% of the bonds in the account were exposed to longer maturity dates which created significant interest rate risk:

Antoine Souma Investment Losses? You Have Legal Options

Investors that suffered investment losses at the advice of Antoine Souma have legal options to recover their investment losses. Contact KlaymanToskes today at (949) 721-9956 to learn more about how FINRA arbitration can help you recover your losses.

Antoine Souma’s History of Misconduct

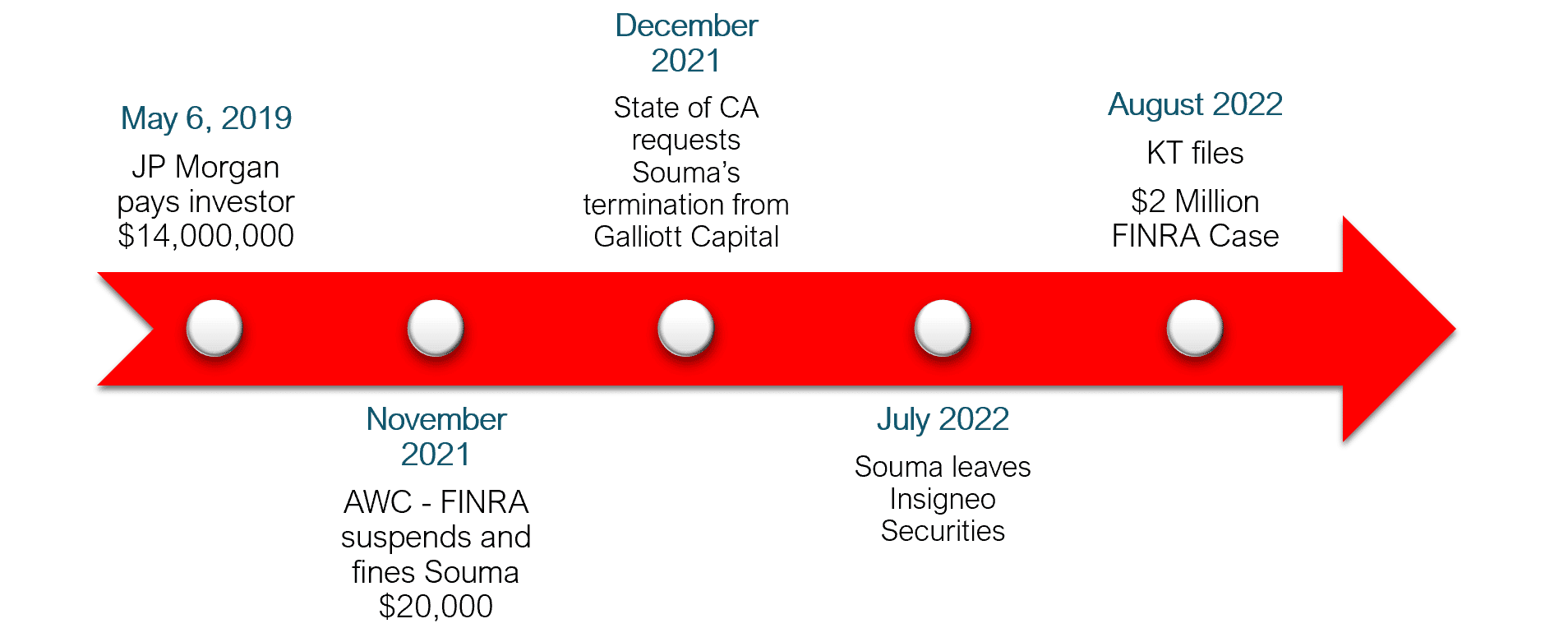

FINRA arbitration case 22-01786 is the latest of several infractions Souma has had with the self-regulatory body. The timeline below displays the notable disclosures on Souma’s BrokerCheck report leading to our recent case filing:

May 6, 2019: J.P. Morgan Securities LLC pays out a $14,000,000 settlement to an investor following a dispute alleging Souma exercised discretion and executed excessive and unsuitable trades. Further, the investor alleged Souma falsified performance reports and failed to extend a promised line of credit.

November 2021: November 5, 2021, FINRA concludes their investigation into the J.P. Morgan allegations resulting in Souma’s Acceptance, Waiver and Consent (“AWC”). Souma was suspended for two months and was fined $20,000.

December 2021: Following Antoine Souma’s suspension from FINRA, the State of California requested Souma’s termination from Galliott Capital LLC. Souma agreed to de-register on a temporary basis as requested by the state.

July 2022: As of July 2022, Souma left the Beverly Hills branch of Insigneo Securities LLC.

August 2022: KlaymanToskes files FINRA claim against Antoine Souma, Galliott Capital Advisors, and Insigneo Securities seeking $2,000,000 for investment losses.

Souma’s Background in Wealth Management

While Antoine Souma is no longer a registered representative, his background includes working with high-net worth clients at the following firms:

- Managing Partner of Galliott Capital Advisors

- Ran The Souma Group at Morgan Stanley Private Wealth Management

- Managing Director at J.P. Morgan Securities

- Vice President at Deutsche Bank and UBS

Galliott Capital Advisors focuses on asset management for high-net-worth individuals. At one point, Galliott managed $1.4 billion in assets for international clients – specifically those in Europe and the Middle East.

KlaymanToskes – Experienced Investment Fraud Lawyers

The investment fraud lawyers of KlaymanToskes have first-hand experience with Antoine Souma’s misconduct. Contact our firm today at (949) 721-9956 to discuss your situation with the attorneys leading the Souma case.

KlaymanToskes in the Media

We have represented employees from the following companies:

Why Choose KlaymanToskes?

What I liked most about KlaymanToskes is they kept me informed of my case. They are excellent professionals.