Millions of investors around the nation rely on financial professionals such as stockbrokers and investment advisors to provide them with sound financial advice and appropriate investment recommendations. Choosing a brokerage firm and financial professional to entrust your money with, is a critical decision and can be a daunting task for inexperienced and sophisticated investors alike.

KlaymanToskes encourages investors to use FINRA’s BrokerCheck tool to learn more about their broker/advisor and brokerage firm. Investors can use this free tool to their benefit in order to mitigate their risk of being a victim of financial misconduct, securities violations, and/or incurring investment losses.

FINRA (Financial Industry Regulatory Authority) is the self-regulatory body responsible for regulating all registered U.S. brokers and brokerage firms doing business with investors in the United States and throughout the world.

FINRA BrokerCheck is a free tool provided by the Financial Industry Regulatory Authority that helps investors learn more about their brokerage firms and financial professionals by accessing their public disclosure history, including pending and settled investor complaints, employment history, regulatory actions, personal bankruptcies, and criminal history.

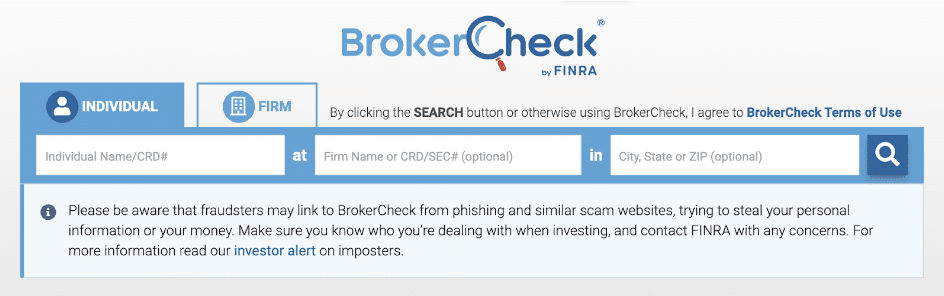

Upon clicking the link and opening FINRA BrokerCheck, investors will see a page displaying the image below. There are two ways to search on BrokerCheck, by remaining on the default “individual” tab, represented by a symbol of a person, investors can search for their individual stockbroker or financial advisor. By clicking on the “firm” tab, displayed with a symbol of a building, investors can search for brokerage firms.

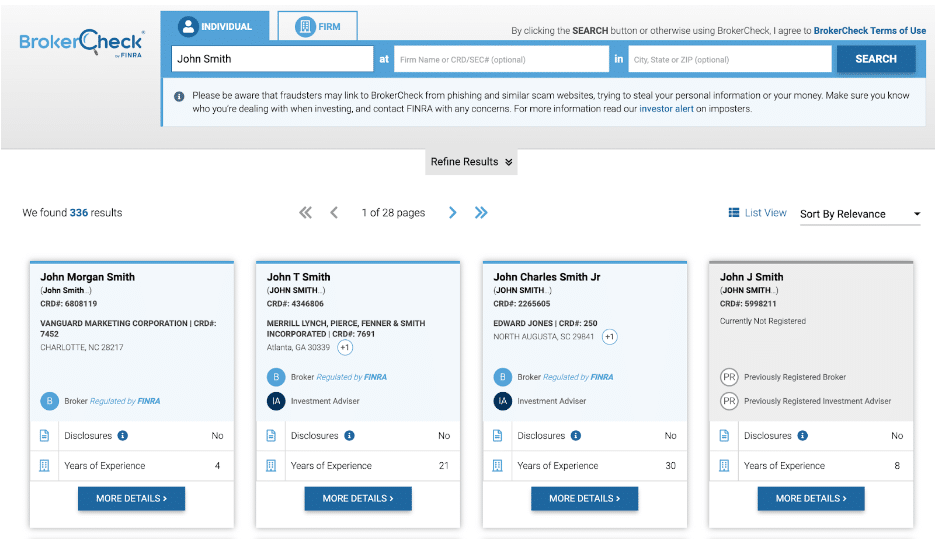

When searching by individual, investors can input any information about the financial professional that they may have. The first box on the left allows an individual’s name or CRD number to be inputted. A Central Registration Depository, or CRD number, is a unique identification number assigned by FINRA to registered brokers and brokerage firms.

If you don’t have the individual’s CRD number, you can still search for the individual using their name, firm name, the firm’s CRD number, and/or the city and state in which they are located. Brokerage firms can be searched on the “firm” tab using the firm’s name, CRD number, and/or the city and state in which the firm is located.

While it is possible for more than one individual broker to have the same name, CRD numbers are unique just like a social security number. After finding the individual you are searching for, their CRD number will be displayed, keep this number for your records to identify the individual quicker in the future. If your search for an individual and it displays multiple results, use other data points such a middle name, firm name, or location, to determine if you have found the correct person.

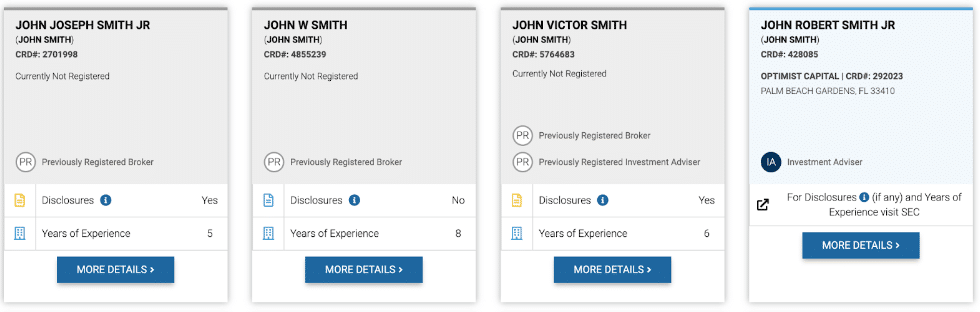

The example above displays an individual search for “John Smith” with no other data points inputted. As seen in the image, potential matches for your search will appear below the search bar, with currently registered individuals displayed in blue and individuals that are not currently registered displayed in gray. These matches will provide the individual’s name, CRD number, current firm (if not “currently not registered”), current location, and whether the individual is registered as a broker, investment adviser, or both. It will also inform you if the individual has received FINRA disclosures and how many years of securities industry experience they have.

Individuals that have received one or more public disclosures will be identified with a yellow symbol next to the “disclosures” line, as seen above. Individuals barred from the securities industry will appear in red. According to FINRA, “Disclosures can be customer complaints or arbitrations, regulatory actions, employment terminations, bankruptcy filings and certain civil or criminal proceedings that they were a part of.” Investors should pay close attention to customer complaints and what allegations other investors have made.

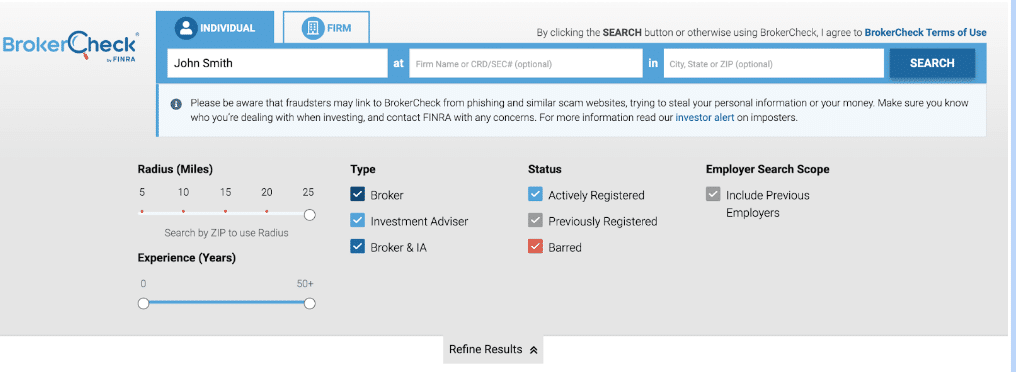

Investors can click on “more details” to select the individual and learn more about what types of disclosures they may have. Individuals that are only registered as investment advisors, such as the individual profile on the right in the above image, will take you to the SEC’s site upon clicking “more details.” If your initial search does not find the individual you are seeking, you can click through the pages provided or click on the “refine results” tab in gray beneath the search bar, as seen in the image below.

The “refine results” tab will allow you to refine your search based off of location radius, experience by years, what type of registration the individual currently has, the individual’s status (actively/previously registered or barred), and whether or not you want to include individuals in your search that were previously employed by the firm you inputted (when including firm name as part of the individual search).

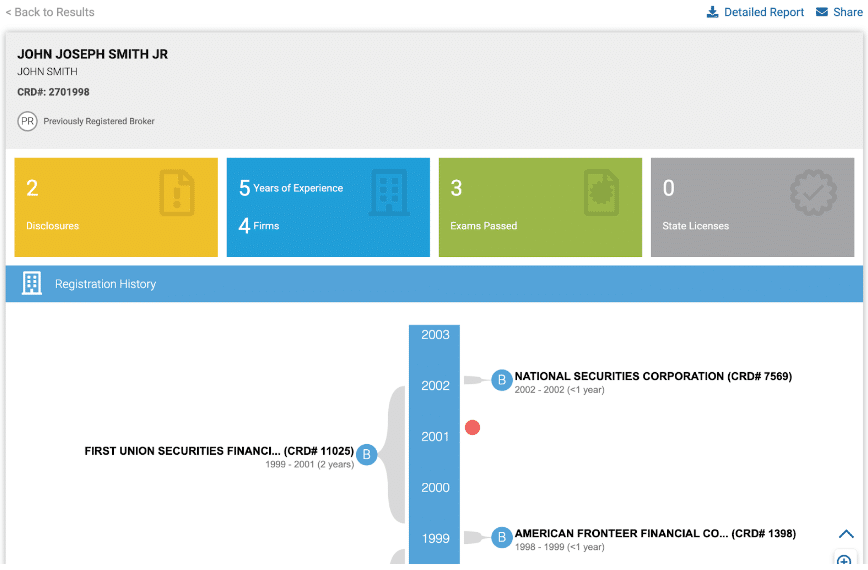

Once you have selected an individual and click “more details,” an individual BrokerCheck profile will appear, similar to the one in the above image. The first half of the page will provide a synopsis of the individual’s information and a timeline of registration history. The timeline will provide employment history including what years the individual was associated with each firm. Disclosures will appear as red dots on the timeline.

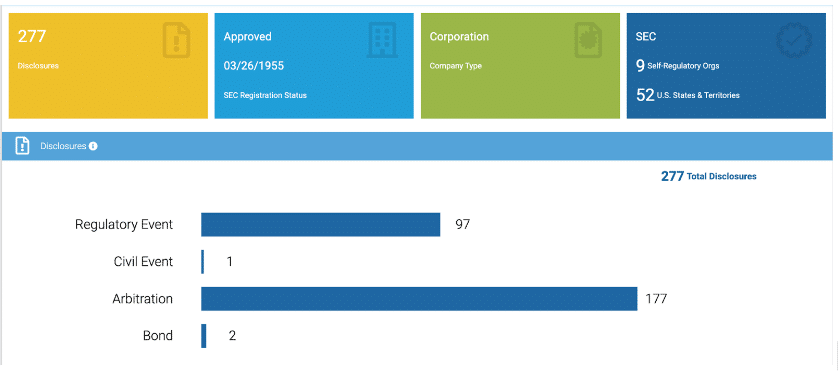

A more in-depth version of the profile can be accessed by clicking on “detailed report” in the upper right-hand corner. This may be your first step to gather information when the individual or firm has too many disclosures to be displayed on the profile itself, as seen in the image below.

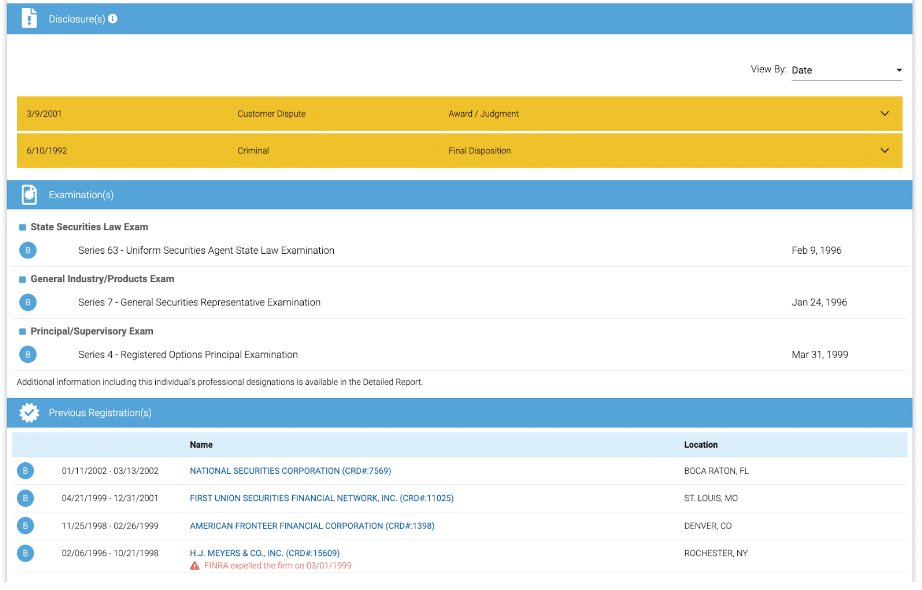

Scrolling further down the individual’s FINRA BrokerCheck profile past the registration history timeline will reveal a “disclosures” section (when applicable) that will display all of the public disclosures received by that individual. As shown in the example below, the date, type of disclosure, and status will be shown for each disclosure.

Clicking on the drop-down arrow on the right hand side of each disclosure will allow more details to be displayed, including but not limited to what regulatory body may have initiated the disclosure, what the allegations are, the type and amount of investor damages alleged, the potential amount of settlement/award received by the investor, and the type and amount of regulatory censure, fine, or other penalty received.

Following the disclosures section, an individual’s FINRA BrokerCheck profile will display examinations the individual has passed and when they qualified, as well as the individual’s previous registrations, dates they were associated with that firm, and location. Expelled firms will appear above a red triangle with an exclamation point symbol and will indicate when the firm was expelled from the securities industry, as seen in the bottom row of the above example.

If your broker’s profile has significant disclosures, KlaymanToskes highly recommends reviewing your accounts for misconduct similar to that alleged in the disclosures.

Investors that believe their investment losses may be a result of misconduct and/or securities violations are encouraged to contact Lawrence L. Klayman, Esq. at (888) 997-9956 or lklayman@klaymantoskes.com for a free and confidential consultation to discuss your potential case today. We do not collect attorney’s fees unless we are able to obtain a financial recovery for you.

A Financial Industry Regulatory Authority (“FINRA”) securities arbitration claim may be the best solution for investors seeking to recover investment losses. FINRA arbitration is a more cost-effective process for investors, often occurring with increased speed and efficiency over litigation. KlaymanToskes has recovered over $250 million in FINRA arbitrations and over $350 million in other securities litigation matters.

This post is intended to be educational in nature and is for the purpose of informing the investing public. The contents of this report are subject to BrokerCheck’s terms and conditions.

KlaymanToskes is a leading national securities law firm which practices exclusively in the field of securities arbitration on behalf of retail and institutional investors throughout the world in large and complex securities matters. The firm has recovered over $250 million in FINRA arbitrations and over $350 million in other securities litigation matters. KlaymanToskes has office locations in California, Florida, New York, and Puerto Rico.

KlaymanToskes, P.A.

Lawrence L. Klayman, Esq.

888-997-9956

lklayman@klaymantoskes.com

www.klaymantoskes.com